|

Merger Failures Value Destruction And How To Avoid It

To fully understand merger failures we need to understand the motivation behind M&A activity - which is primarily about the creation of value by exploiting [what is euphemistically referred to as] synergies.

"Synergies"The word "synergy" entered merger vocabulary during the 1960s merger wave, and was used to describe gains from conglomerate mergers that could not be readily identified, but were presumed to be present to explain why the mergers occurred (Mueller & Sirower 2003). If it were not for the catastrophic rate of merger failures and the destruction of shareholder value and, most importantly, the human cost, then this could be amusing. But to my mind it isn't, it is an appalling indictment of the business world and their advisors that [just as in the world of change management] 70% of all M&A activity fail to realise the intended benefits.

Technically speaking, "synergy" is defined as the increase in the merging firms’ competitive strengths and resulting cash flows beyond which the two companies are expected to accomplish independently (Seth 1990; Sirower 1997). Bibler’s (1989) definition of synergy is expressed as 1+1=3[!]. He further proposes that the definition should be: “an acquirer’s being able to use its significant strengths to improve the performance of the acquired company, or taking one of the acquired company’s strengths to bolster a weakness of its own”. In case you feel that I am partial in my view of all these merger failures, I cite the overwhelming evidence of academic and professional studies and reports, to take just one example: Mueller and Sirower (2003) developed a methodology that used the distribution of gains and losses across two samples of firms, and their relationship to one another to test four hypotheses about why mergers occur. They analysed 168 mergers between large companies from 1978 to 1990 [to include an exploration of merger successes and merger failures]. Their findings reported that little or no support was found for the hypothesis that mergers create synergies or that shareholders of both the acquiring and acquired firms share gains from these synergies. Instead, they discovered that was considerable support for the respective "managerial discretion" and "hubris" hypotheses, that suggests that mergers are “purely for growth” and at the discretion or for the hubris of top management who have vested power to decide on M&A. [No wonder the merger failures rate is so high!]

Warren Buffett on mergers...This is what Warren Buffett had to say on the subject of merger success and merger failures [in his 1981 Berkshire Hathaway Annual Report]:

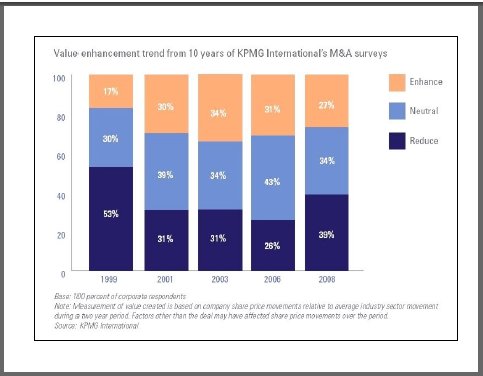

KPMG Survey - mergers and value enhancmentAccording to a survey published by KPMG in 2008, the proportion of M&A deals that have reduced value has increased by 50 percent in the two years since their previous survey.

Take a look at their statistics of "Value Enhancement Trends" over the past 10 years:

KPMG Merger Value Enhancement Trends

Further highlights from the KPMG survey [see link below for full report]

Major causes of merger failure are all people relatedA survey conducted by A.T. Kearney in 2004 to identify the most critical phase to merger success or merger failures, revealed that 30% of survey respondents emphasised the importance of the pre-merger phase; only 17% indicated that the middle phase presented the greatest risk of failure; while the majority of 53% stressed that the actual implementation phase – often referred to as the “post-merger integration” phase – bears the greatest risk. Ironically - but perhaps not surprisingly, however, this post-acquisition phase is the most ignored.

A brief review of the business academic studies into the factors impacting merger failures reveals the following:

I am indebted to Dr Dominic Fong for the above information as cited in his doctoral thesis: "The role of the psychological contract in affecting employee behaviour under the influence of merger and acquisition: a study of local regional managers in Hong Kong". Curtin University of Technology, Graduate School of Business, Curtin Business School.

Cultural conflicts at the root of failure merger failuresContinuing with Dr Fong's invaluable research, I am quoting extensively below on his research into reasons for and factors impacting merger failures. I want to make the point and provide the academic research that supports the view that is indicated by the statistics [as illustrated in the KPMG report above]. Clearly, whilst people issues are not the only reasons for merger failures they are a significant and frequently ignored factor. As Dr Fong says: "One critical factor that befalls a merger is cultural conflicts...."

Articles & Resources

"We call these risks the 'nine deadly sins.' Understanding them is a critical first step toward a successful merger."

"In the study, HR professionals listed incompatible cultures as among the biggest obstacles to success in mergers and acquisitions." "The companies may go in and do due diligence, look at all the financial matters, but it’s really the cultural and people issues that can mean the demise of a successful merger."

"This may happen during pre-merger negotiations or during post-merger integration. Despite all Due Diligence, the two partners of a merger fail to form a new successful unit that is able to exploit all synergies."

"This article proposes a three-stage model of mergers and acquisitions that systematically identifies several human resource issues and activities. Numerous examples are offered to illustrate the issues and activities in each of the three stages."

GRAPHIC - How to Manage Change During a Merger Integration - Bain & Co GRAPHIC - A Strategic Guide to Merger Integration - Bain & Co REPORT - Change Management in Merger Integration - Bain & Co

A very personal perspective...What really bothers me is the way the system currently works for remunerating all of the professional advisors who provide services to the corporate world. These people get paid via a combination of time sheet based fees and "by results" i.e. the securing of the deal - which so often is linked to a percentage of the value of the deal, so the bigger the deal - the bigger the fee... [you can see where this is leading]. Senior executives are also remunerated via relatively short-term incentives - which of course are never, ever linked to any downside that the company may experience as a result of, and during, their "stewardship" - as we have relatively recently witnessed in the banking sector. This, in my view, is a very unhealthy combination as it combines the short-term vested very personal interests of people who are responsible for the interests and welfare of many stakeholders, with professional advisors who have a potentially massive short-term advantage for "pushing the deal" - and absolutely no linkage with the outcome of their "professional" advice and the likelihood of taking their deal into the 70% of merger failures. To be reflective for 30 seconds: life is not actually a "a zero sum game" - we are all inter-connected... Don't get me wrong - I like earning money - lots of it! "Greed is very good" - just as long as it works for everyone involved in the deal... All this is very reminiscent of the "bad old days" [in the UK at least] where so called financial advisors were highly incentivised to sell inappropriate life insurance and pension schemes via heavily "front-end loaded" commission deals. I would welcome the day when professional advisors and senior executives have a significant part of their large remuneration linked to the medium term [i.e.3-5 years] shareholder value they created - cos I somehow feel that might go a long way to redefining the whole concept of "synergy" - oh and incidentally reducing the percentage of merger failures. Excuse the lateral thinking for a moment - but can you imagine civil engineers or construction companies or the people who build nuclear power stations - working on the same basis - where a 70% failure rate was accepted? Can you? So why on earth should the world of business be any different? Why does this bother me? Quite simply, because of the very considerable, unnecessary, and totally avoidable human cost. Oh, and before you ask, yes I frequently link my fees to outcomes. I like it that way - cos I get paid more!!

How to avoid these risks of merger failures...Having established that there are so many merger failures that do not deliver the promised benefits and increases in shareholder value and explored the people and cultural aspects, what can we conclude?

There are several reasons why this is often not addressed: first and foremost because the focus is on getting the deal done; secondly the incentive of fat fees for the advisors, thirdly because a corporate culture is hard to see (especially if you are in it) and this is compounded by the fact that there is often more than one culture, and finally because it is hard to talk about. And yet…. the price of failure comes extremely high!

Don't take my word for it, hear what respected Harvard professor John Kotter has to say about the impacts of change.

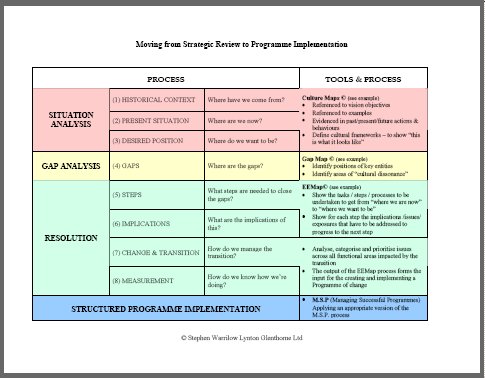

Strategic Planning & Cultural Analysis

See here for an overview of the EEMap process

This process allows a company to test the impact of a proposed business initiative or venture on those people most affected by it, to identify why it may fail and to establish precisely what has got to be done to make it a success. This tool can be applied to a proposed merger as part of a HR due diligence process, to identify and assess the cultural issues that will be encountered and to thus to assist with the avoidance of merger failures. The tool is sufficiently flexible and scalable to be adapted, modified or enhanced to meet a specific requirement. Principal benefits are that it is low tech and simple to understand and apply, it involves staff at any or all levels and enables them to articulate difficult issues in a non-confrontational way, and it can be undertaken quickly and before large sums of money are irrevocably committed to the proposed merger. There are three phases to the EEMap process: (1) Situation Analysis – that defines a cultural frame work for the company and will also identify all of the significant subcultures within the company that will assist or resist progress towards the business objectives of the proposed venture. (2) Gap Analysis – plots the positions of key entities within the company and highlights the gaps between this and where the directors say or think the company is, and where they want to be. (3) Resolution – shows the tasks, steps and processes that have to be undertaken. All implications, issues and exposures are analysed, categorised and prioritised across all functional areas impacted by the proposed venture.

Further resources

Business Culture - the effects of your culture on change management Organisational Culture - Determines how your people will respond to a change initiative Programme Planning - The pre-programme review and planning process

Key factors to address BEFORE embarking on a change intiativeChange Management Risk Assessment Change Management Implementation Change Equation - INPACT Assessment Leadership Qualities - Creating a Change Culture

|